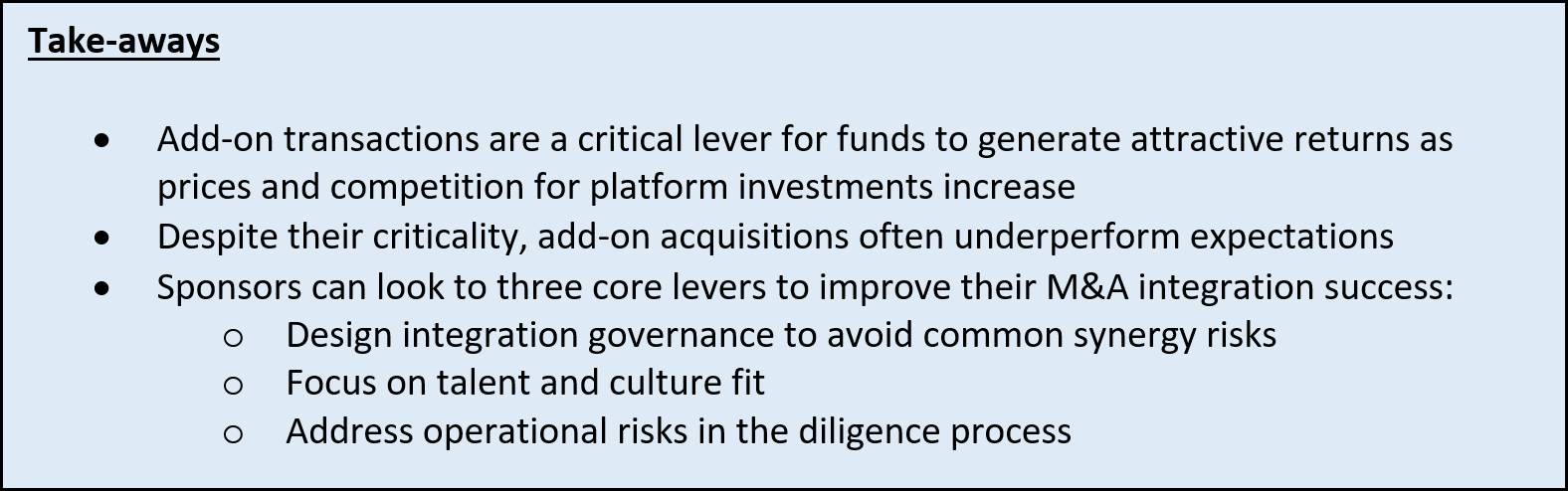

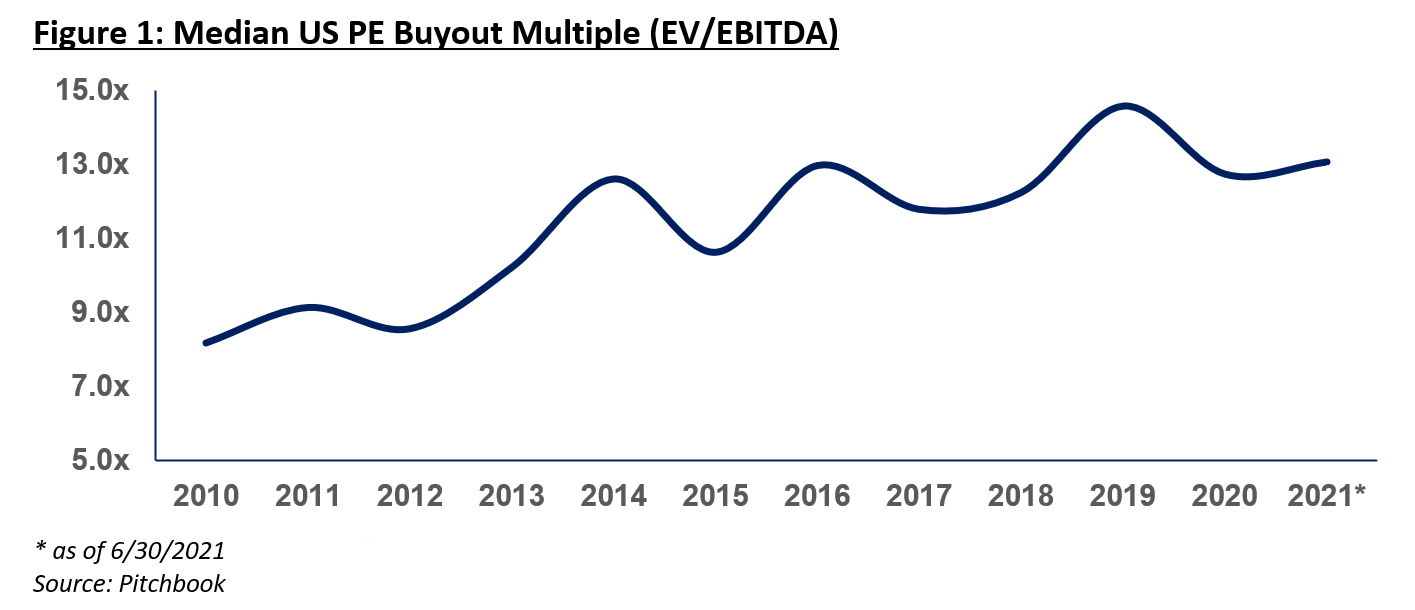

Maximizing Returns in the Post-COVID World

The past year has seen a remarkable rebound in investment activity deal flow. While this provides ample exit opportunities for companies and Sponsors, it also raises the stakes for new owners to generate future returns. As entry multiples reach all-time highs, Sponsors must have multiple avenues to drive value creation in their platform investments.

Priced for Perfection

A number of factors are driving increased competition for quality platforms, from the continued increase in capital flows and dry powder to the dramatic post-COVID economic recovery. The end result is the same — Sponsors are paying top dollar for new investments, leaving little room for error in executing the investment thesis. Outsized returns will often rely on accretive add-on investments, as purchase prices fully reflect organic growth opportunities. To succeed in the current market, Sponsors must work with their management teams to identify and integrate accretive acquisitions.

We have looked across the hundreds of transactions we supported and have identified three common issues, as well as steps Sponsors can take to position themselves for success. While no plan is ever perfect, focusing on these critical success factors will help teams identify and avoid key integration risks.

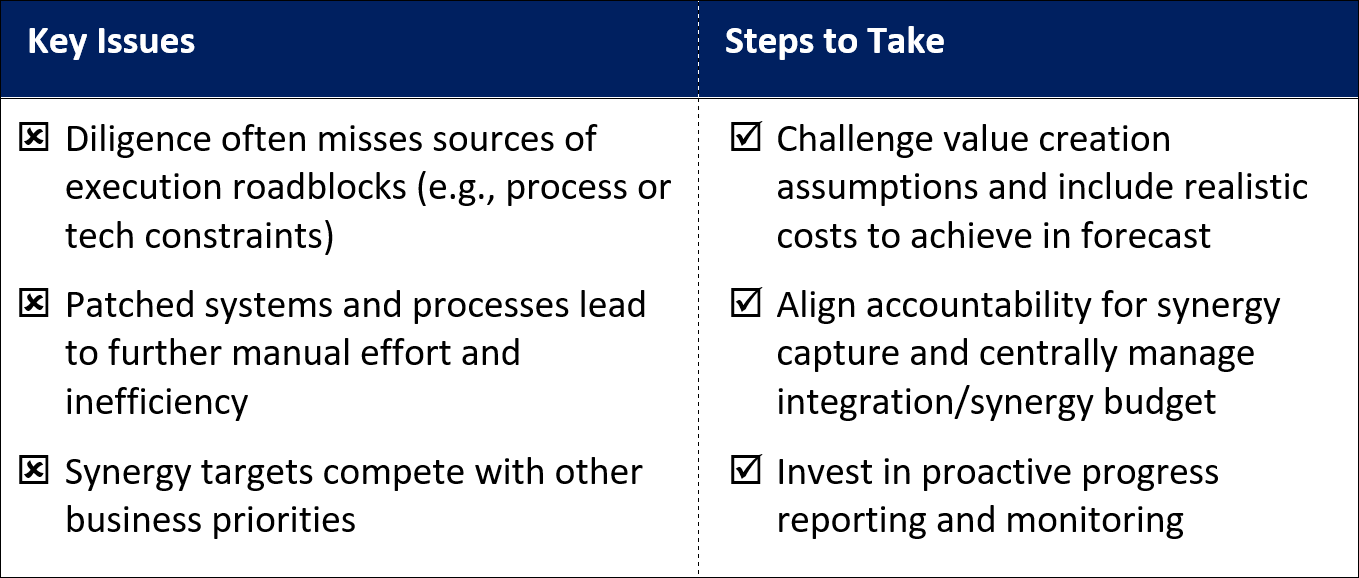

1) Maximize Synergies

Acquisition integrations often do not fully achieve their targeted synergies and/or timeline, either because of unforeseen issues, insufficient implementation funding, or lack of attention post-closing. The good news is Sponsors can address these issues by incorporating stronger central governance.

Centralized management of both integration and other transformation capex ensures that (i) costs to achieve are properly funded and (ii) reporting and scorecards are implemented across the entire leadership team, driving accountability for results. Formalizing a set of “vertical” (e.g., business line) and “horizontal” (e.g., expense line) owners and targets is typically a best practice. For example, both business line leaders and the CIO should have explicit targets and accountability for IT synergies, addressing both “demand” (e.g., support requirements) and “supply” (e.g., labor sourcing/cost) levers.

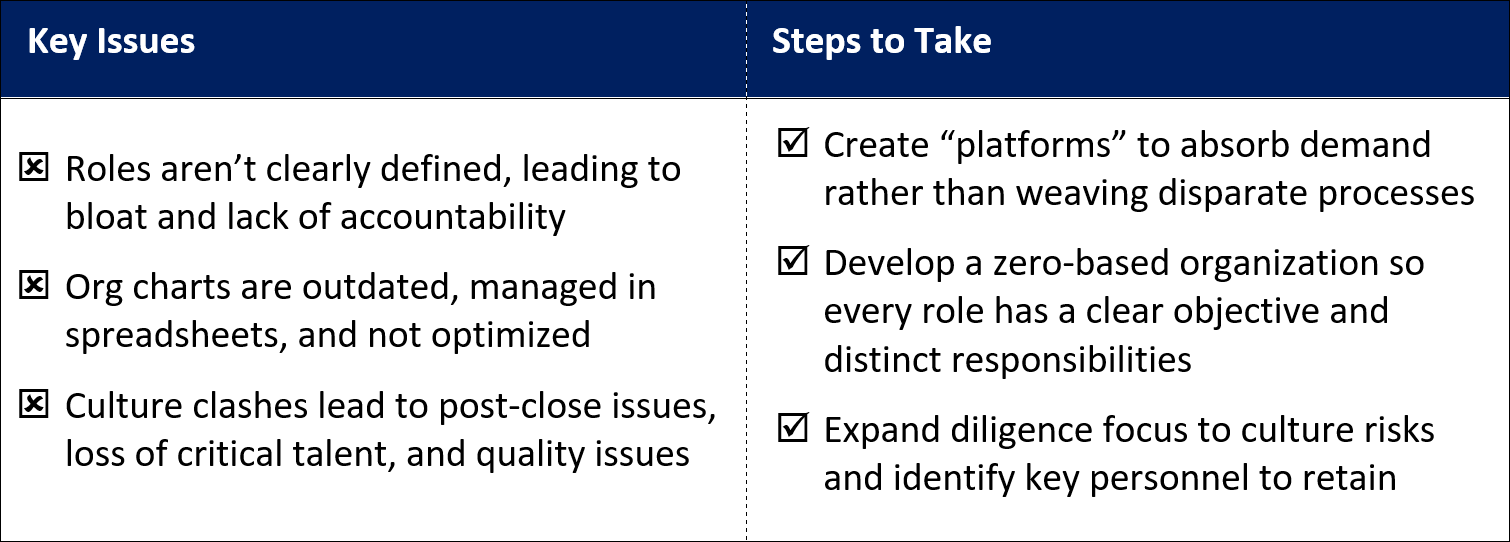

2) Emphasize Talent and Culture Fit

Culture is a key part of a successful merger; however, it is often an afterthought during due diligence. Teams are merged in name only, where redundant processes may continue, or managers have vague or overlapping responsibilities. Best in class operators can avoid these pitfalls by implementing platform-like processes and capabilities to absorb additional workload. This provides a scalable way to grow, minimizes management layers, and maintains a strong linkage between leadership roles and accountabilities (e.g., throughput or quality metrics for processes).

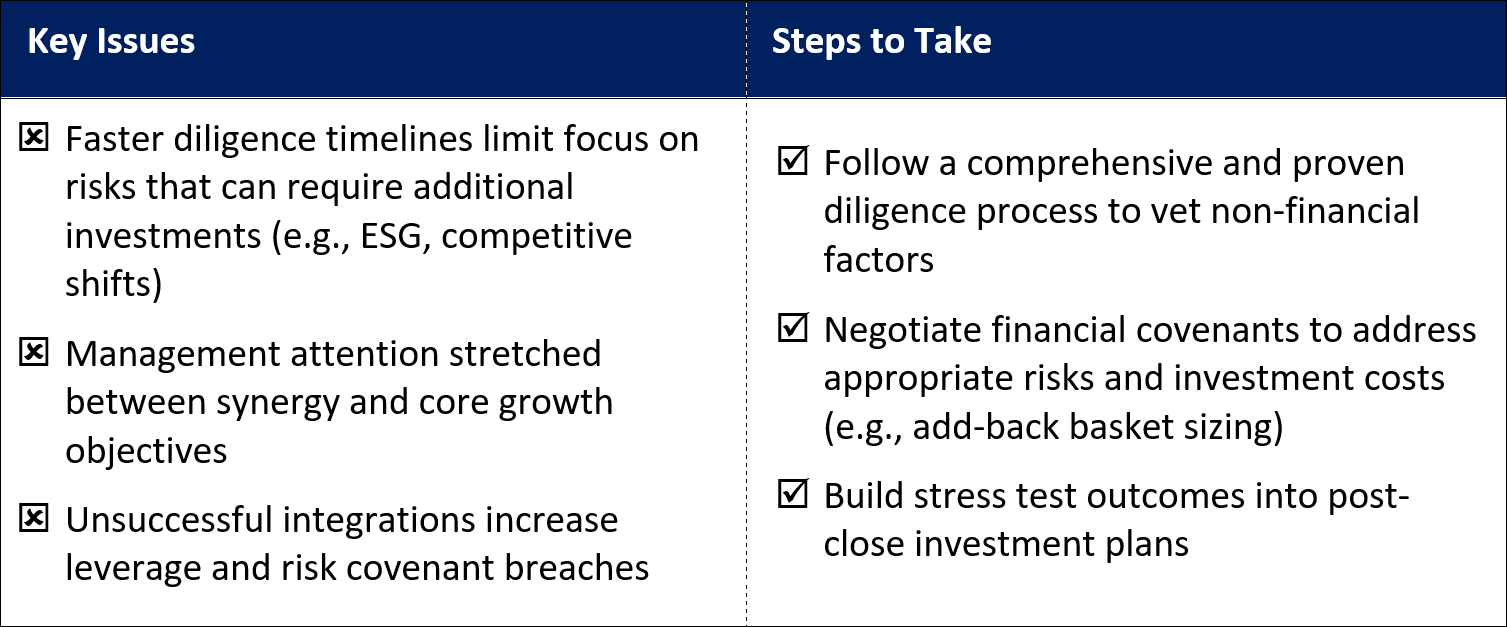

3) Minimize Operational Risk

As competition for deals increases, teams are under more and more pressure to move quickly, leading to due diligence shortcuts or time constraints. Management teams can easily get stretched thin between reviewing acquisition opportunities and managing their day jobs. While there can be pressure to use internal teams to manage costs or because they have the best working knowledge of the acquiring organization, distractions or mistakes in due diligence can create long-term challenges for value creation and also increase the risk of an over-leveraged capital structure.

Sponsors should recognize the significant workload involved in typical due diligence and work with a network of advisors who have a robust and proven playbook to efficiently validate financial and operational fit. Then an exhaustive vetting of potential show-stopper risks can be conducted with the proper information, analysis, and attention. Leveraging teams that specialize in this process can provide a significant advantage for management and enable the best chances for success.

Conclusion

Investment teams are always looking for ways to generate additional returns – proprietary sourcing, cost reduction, increasing sales and marketing resources, etc. While these organic levers are still important, they become table stakes as competition bakes these factors into acquisition prices. Sponsors will also need to rely on add-on acquisitions to drive attractive returns. Focusing on our core levers will help teams avoid the most prolific root causes for underperformance and create a foundation for success.